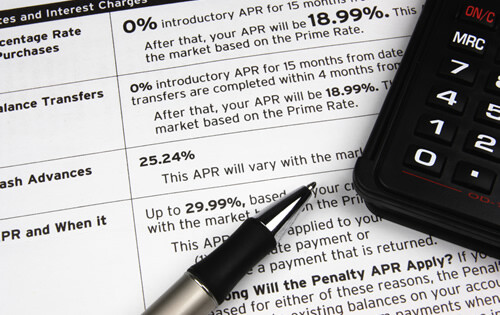

What’s the Best Way to Manage High Interest Credit Card Debt?

Let’s face it: being buried in high interest credit card debt is not the ideal situation. Unfortunately, millions of people find themselves in this position for one reason or another. If you’re one of them, it’s essential to focus on the many ways to manage your debt as to improve your future. Here are some … Read more