Reasons Why a Balance Transfer May Not Make Sense for You

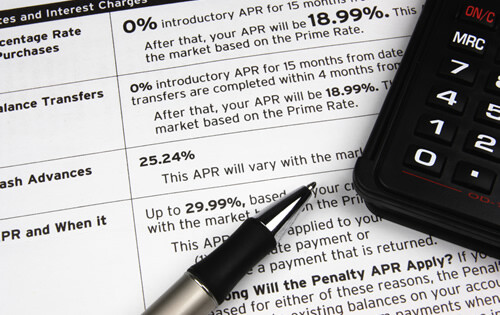

Are you interested in taking advantage of a balance transfer as to improve your financial situation? While this is a great decision for many people, it may not be the right choice for you at the present time. For this reason, you need to compare the pros and cons, while focusing heavily on your particular … Read more