Have you come to the decision that now’s the best time to transfer your high interest credit card debt to another card?

If so, you need to take one very important step: compare as many balance transfer credit card offers as possible.

As you do so, pay close attention to these three details:

1. Balance Transfer Fee

You will pay a fee, typically a percentage of the transfer balance, in order to complete this transaction.

Simply put, you want to find an offer with a competitive balance transfer fee. You can expect to pay somewhere in the one to three percent range.

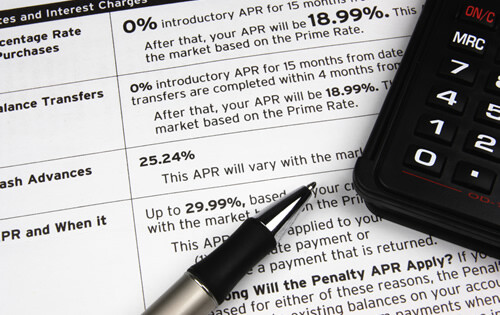

2. Length of the 0 Percent Rate

How long will the zero percent rate remain in place? Most balance transfer credit cards have an introductory zero percent rate for a period of 12 to 18 months. If you’re concerned about paying off your balance before the rate expires, search for an offer with the longest introductory period.

3. Future APR

Once the introductory period comes to an end, your balance will be subject to the interest rate that kicks in at that time. Before making a final decision, get a better idea of what this interest rate will be.

This is a particularly important detail if you aren’t confident in your ability to eliminate your balance before the introductory period expires.

Conclusion

These may not be the only details to compare when searching for the best balance transfer credit card, but you definitely want to pay close attention to all three.

As long as you’re confident with the decision you make, you can transfer your balance with the idea that it will improve your financial life now and in the future.